It’s that time of year again: tax season. In fact, in less than a month, your taxes are due. (Insert look of horror here). Tax pro tip – if you’d like to avoid the look of horror next year, put a reminder in your calendar for February 20th, 2019. This will give you plenty of time to gather all your tax documents after the January 31st postmark deadline.

In fiscal year 2016, the average individual tax return was approximately $2590. That’s a pretty nice chunk of change as compared to the average household income. Maybe your tax return won’t be quite as much, or maybe it will be more. Do you know what you’ll do with those dollars once they are in your bank account? My number one suggestion… –

Don’t spend it immediately. Plan first.

By planning you prevent the imminent financial disaster that is extra money in your bank account: the unnecessary shopping spree, the expensive trip to dinner, the new iPhone you just couldn’t live without. Sure, all of these things are legitimate ways to spend your tax dollars, but do them all, and you’re left back where you started – at bank account ground zero.

I’ve drummed up a few ways you can spend your tax refund dollars, and don’t worry they’re not all about #adulting.

#adulting

Take baby steps toward achieving financial freedom

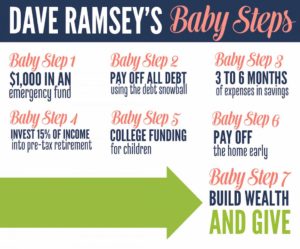

On the top of our current financial goals list, is finding our way towards financial freedom. My husband and I have actively researched many different methods, but like the layout of Dave Ramsay’s “Baby Steps”. If you’re not familiar, check out the article on his website or this super cute infographic from the Crazy Together blog. Baby Steps 1, 2, and 3 are all great choices for some of those refund dollars. We’ll be working toward Baby Step 2, and paying off one of our vehicles.

Invest!

Open a PA 529 for your kid(s). These accounts receive a number of tax breaks to encourage contributions, and are a great way to save for college or technical school, as well as any qualified expenses. Learn more on the PA529 website.

Add to or start a new individual or joint investment account. Don’t know where to start? Find a qualified financial advisor who can help you plan for the future. I’ve found that one of the best ways to find the right fit, is to ask financially like-minded friends if they have an advisor they have a good relationship with.

Invest in your home. Want to see your money working? Invest in your home. Need a new roof? Want to finish that guest bathroom (that isn’t really suitable for guests)? Use some or all of your refund to tackle your household to do list, and increase your home’s value.

Invest in yourself. Is there something you’ve always wanted to learn how to do or a topic you’d like to learn more about? Invest in yourself by taking a class at your local community college. Many community colleges offer classes in cooking, photography, graphic design, a variety of languages, and many other fields of interest. Use your skills to make a some extra bucks on the side, and you may even earn back your initial investment.

I know, #adulting isn’t at the top of my list either, but once you’ve achieve major financial goals, you have more time and money to #havefun, and there’s nothing wrong with choosing something from each list. So let’s use a little refund money and…

#havefun

Take a vacation. Who doesn’t want to go on a vacation when its March in Western Pennsylvania?

I’ll leave this one open to your imagination, but remember, a vacation doesn’t have to be expensive (ie. don’t blow the entire refund on one category we’ve mentioned).

Treat yourself. Have a girls’ spa day. Get a mani/pedi, or a cut and color. Go shopping for a new outfit. Something you wouldn’t normally splurge on. Make it special, and just for you.

Buy or do something you have wanted for a while, but couldn’t (or wouldn’t) afford. Is there something you’ve wanted to purchase for a while, but didn’t want to spend the money? A new phone or tablet? An item that’s been on your Amazon list since last Christmas, but Santa didn’t deliver? This is your chance, choose wisely.

What will you do with your tax refund? #adulting or #havefun? Comment below or join the conversation on our social media pages.